Not known Details About Pvm Accounting

Not known Details About Pvm Accounting

Blog Article

Our Pvm Accounting Diaries

Table of ContentsThe Pvm Accounting StatementsLittle Known Questions About Pvm Accounting.The Pvm Accounting IdeasPvm Accounting Things To Know Before You BuyThe Best Guide To Pvm AccountingNot known Factual Statements About Pvm Accounting

Supervise and handle the production and approval of all project-related billings to consumers to promote excellent communication and stay clear of problems. construction bookkeeping. Make certain that proper reports and documentation are sent to and are updated with the internal revenue service. Ensure that the bookkeeping procedure complies with the legislation. Apply called for building audit standards and procedures to the recording and coverage of building and construction activity.Interact with various funding firms (i.e. Title Business, Escrow Business) relating to the pay application procedure and needs required for settlement. Aid with applying and keeping inner economic controls and treatments.

The above declarations are meant to explain the general nature and degree of work being done by individuals appointed to this classification. They are not to be interpreted as an extensive listing of responsibilities, responsibilities, and abilities needed. Workers may be required to perform tasks beyond their normal responsibilities every now and then, as required.

Unknown Facts About Pvm Accounting

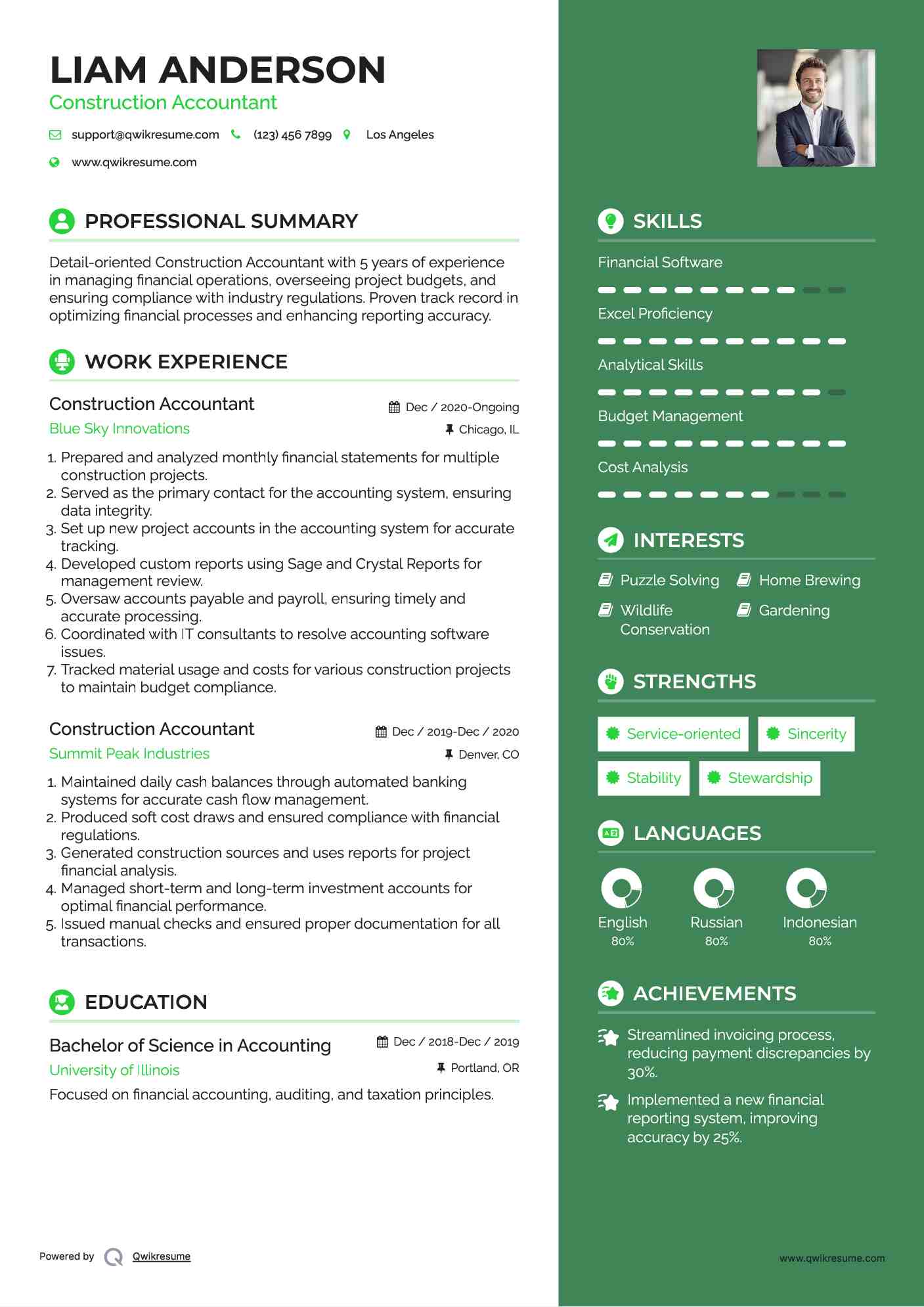

You will aid support the Accel group to make certain delivery of successful in a timely manner, on spending plan, projects. Accel is seeking a Construction Accounting professional for the Chicago Office. The Building Accountant executes a selection of bookkeeping, insurance compliance, and project management. Works both independently and within particular divisions to keep financial records and make sure that all records are maintained present.

Principal duties consist of, yet are not restricted to, dealing with all accounting features of the business in a timely and accurate way and providing reports and schedules to the company's certified public accountant Firm in the prep work of all financial declarations. Makes certain that all bookkeeping treatments and features are managed properly. In charge of all monetary records, payroll, banking and day-to-day procedure of the accounting function.

Works with Project Managers to prepare and publish all regular monthly invoices. Creates month-to-month Job Price to Date reports and functioning with PMs to resolve with Task Managers' budgets for each task.

All about Pvm Accounting

Effectiveness in Sage 300 Construction and Actual Estate (formerly Sage Timberline Workplace) and Procore construction administration software application an and also. https://www.pubpub.org/user/leonel-centeno. Must additionally excel in various other computer software application systems for the preparation of reports, spread sheets and other audit analysis that might be called for by administration. Clean-up accounting. Must have solid business abilities and capacity to prioritize

They are the monetary custodians that ensure that building tasks remain on budget plan, abide by tax laws, and preserve monetary openness. Construction accountants are not just number crunchers; they are critical partners in the construction process. Their main function is to take care of the financial aspects of building jobs, making sure that sources are allocated efficiently and monetary dangers are lessened.

The 8-Second Trick For Pvm Accounting

By preserving a tight grasp on job finances, accounting professionals assist prevent overspending and economic obstacles. Budgeting is a cornerstone of effective building tasks, and building accountants are critical in this regard.

Browsing the complicated internet of tax regulations in the building industry can be difficult. Construction accounting professionals are well-versed in these guidelines and ensure that the task follows all tax obligation requirements. This includes handling payroll tax obligations, sales tax obligations, and any type of various other tax responsibilities details to building. To succeed in the role of a building and construction accountant, individuals require a solid academic structure in accounting and financing.

In addition, qualifications such as Licensed Public Accounting Professional (CPA) or Certified Construction Industry Financial Specialist (CCIFP) are very related to in the market. Construction projects often entail limited due dates, changing regulations, and unanticipated costs.

How Pvm Accounting can Save You Time, Stress, and Money.

Specialist qualifications like certified public accountant or CCIFP are additionally very advised to show experience in building and construction audit. Ans: Building and construction accounting professionals produce and keep track of budget plans, identifying cost-saving opportunities and ensuring that the task remains within budget plan. They also track expenses and projection monetary requirements to avoid overspending. Ans: Yes, construction accounting professionals handle tax compliance for building and construction jobs.

Introduction to Building And Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business need to make tough choices amongst many economic alternatives, like bidding process on one project over an additional, selecting funding for materials or devices, or setting a job's earnings margin. Building is an infamously volatile market with a high failing rate, sluggish time to settlement, and irregular cash money flow.

Production entails repeated procedures with easily recognizable costs. Manufacturing calls for different procedures, materials, and devices with varying expenses. Each task takes place in a brand-new location with varying website conditions and special challenges.

Pvm Accounting Can Be Fun For Anyone

Frequent use of different specialized contractors and suppliers affects performance and cash money circulation. Payment arrives in full or with regular payments for the complete agreement amount. Some part of payment may be held back till job completion even when the contractor's job is ended up.

Routine production and short-term contracts bring about convenient money flow cycles. Irregular. Retainage, slow-moving settlements, and high in advance costs lead to long, uneven money flow cycles - construction bookkeeping. While traditional image source suppliers have the benefit of controlled environments and maximized production procedures, building and construction business must constantly adjust to each brand-new job. Even rather repeatable projects require adjustments due to website conditions and various other aspects.

Report this page